Navigating the Risks of Saving Money in 2023

Written on

Understanding Wealth in Perspective

To begin, it’s essential to clarify that I am not a financial advisor. With that in mind, let’s address a painful truth regarding wealth: you might be more affluent than you realize.

You might think, "I’m not wealthy; I live a modest life with a regular income." Here’s an eye-opener:

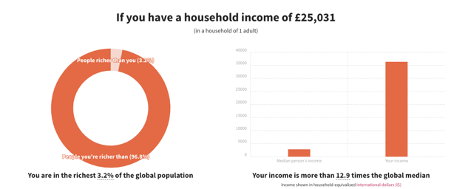

For those in the UK, the median salary stands at £31,772. After taxes for the 2022/23 fiscal year, this equates to a take-home pay of around £25,031.

Remarkably, earning this average salary places you among the richest 3.2% of people globally. In the US, median earners, with a salary of $55,000, find themselves in the top 2%. However, wealth is often relative.

Despite ranking in the top percentiles, it’s easy to feel inadequate when comparing yourself to celebrities flaunting their luxury cars while you drive a reliable older model.

The Flawed CPI

The Consumer Price Index (CPI) is often criticized as a manipulated measure of inflation. It is derived from the price differences of 700 goods and services, yet the items included frequently change, raising questions about its accuracy.

Source: Statista — historical inflation rates in the UK since 1989

This manipulation contributes to the ongoing cost of living crisis, where prices have surged over 10% compared to 2020.

Savings Landscape in 2023

In 2023, the average UK citizen has approximately £17,365 in savings. Notably, 34% of adults report having no savings or less than £1,000. Conversely, 61% save either every month or most months. If you have savings, you are already in a better position than many.

If savings aren't within your reach, don’t lose hope; economic cycles create opportunities for wealth accumulation.

Strategies to Safeguard Your Savings

While I am not in a position to offer financial advice—being merely 24 and navigating my first significant recession—I have gleaned valuable insights from historical contexts.

Consider opening an Individual Savings Account (ISA). This allows you to invest up to £20,000 each year, tax-free. I personally use Freetrade for my Stocks & Shares ISA, which I find user-friendly.

If you feel lost regarding investments, consider Exchange-Traded Funds (ETFs) and Index trackers, which can simplify the process.

Diversifying Your Assets

Explore various investment avenues beyond traditional savings accounts. Learn about stocks, bonds, ETFs, commodities (like gold and oil), cryptocurrencies, and real estate. Each option has distinct risk profiles.

Currently, my monthly income allocation looks like this:

- Cash (savings): 15%

- Bitcoin: 30%

- Individual Stocks: 15%

- ETFs: 20%

- Commodities: 20%

Start small—perhaps by dividing your funds between just two asset types (e.g., cash and stocks). As you become more comfortable, gradually expand your portfolio.

Addressing the Education Gap

It's crucial to acknowledge that the nuances of savings, banking, and inflation are often overlooked in traditional education. If everyone were informed, the wealthiest would lose their edge over the uninformed.

Final Reflections

You might initially react strongly to the truths about the banking system and financial realities, as I did. Channeling this frustration into a desire to educate others can be transformative.

Everyone's financial journey is unique, so I encourage you to conduct a thorough self-assessment of your finances. Numerous online tools, including budgeting spreadsheets, can assist in this process.

By investing regularly, you can mitigate the impact of inflation and retain more of your wealth.

Keep your finances secure, and remember, it’s wise not to keep all your savings in low-interest accounts.

Thank you for taking the time to read this. If you appreciate my work, feel free to support me at Ko-fi.com/sammillan.

Discover why saving money in certain accounts may not be the safest choice for your financial future.

Learn how I saved over R200,000 in 2023 and explore practical money-saving tips for achieving your financial goals in 2024.