Investing in Cryptocurrency: My $7,500 Journey and Future Plans

Written on

Chapter 1: My Crypto Portfolio Experience

Yesterday, I took a moment to review my cryptocurrency portfolio, and let’s just say, the figures were disheartening.

I found myself down by $7,594.

Surprisingly, I handled the situation well—I only spent three hours feeling upset about it.

Here's a snapshot of my portfolio's performance over the past 18 months:

(Just a note: I stopped tracking daily data from April 2022 until now, which is why the chart appears inconsistent.)

At one point, I was up by $5,000, but now I’m facing a loss of $7,500.

"So, how are you feeling about this investment, Tom?"

"Are you ready to admit you were wrong?"

Honestly, I feel great.

And the answer is no.

Here's my reasoning.

This is the Perfect Time to Invest

It’s surprisingly straightforward to succeed in the financial markets.

The strategy is simple: wait for the panic selling to hit, and then make your purchase.

Buying becomes easy when the market is thriving.

However, those who accumulate significant profits in cryptocurrency often do so when few believe in its potential.

Right now, purchasing Bitcoin isn’t exactly trendy.

Bitcoin is reminiscent of a 2022 Tom Brady—overhyped, overvalued, and it has lost a significant amount of its worth.

That’s a positive sign.

It signals an excellent buying opportunity.

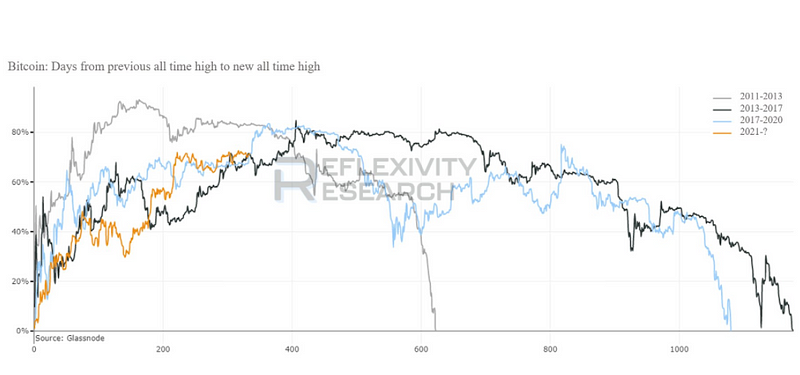

According to Will Clemente, a well-known crypto analyst, the time it typically takes to reach a new Bitcoin all-time high after the previous high is around 1,000 days.

Currently, we are about 350 days since the last peak price.

Historically, we have a considerable journey ahead of us.

Section 1.1: My Faith in Bitcoin's Value

At present, Bitcoin is trading around $19,000 per coin, which is still quite impressive compared to its price of roughly $9,000-$10,000 in early 2020.

I genuinely believe in this technology; I’m committed to holding my investments—even if Bitcoin were to plummet to zero.

I would rather stand by my beliefs than backtrack if I’m proven wrong.

Initially, I invested about $12,000 into cryptocurrencies, and now its value has dropped to approximately $4,500. Quite alarming, isn’t it?

However, I remind myself that this $7,500 loss is not yet realized since I haven’t sold any of my holdings. I’m optimistic that Bitcoin will surge again, especially around the next halving event.

Subsection 1.1.1: My Future Plans

My confidence stems from my belief in the underlying technology. Over the past 18 months, I’ve immersed myself in books, videos, and various resources about cryptocurrency.

I believe that the most robust technology has the best chance of succeeding.

I’m writing this to share an update on my cryptocurrency journey. I used to be quite vocal about my investments, but lately, I’ve kept a lower profile (mostly due to the market's stagnation).

Yet here I am, facing a $7,500 loss, unfazed.

I invested funds that I was ready to part with, knowing that volatility is an inherent aspect of the crypto market, which is what makes it appealing for investors.

We are still in the early stages.

My strategy moving forward is to purchase more when the opportunity arises. If someone told me I could buy Bitcoin at $19,000 during the summer of 2021, I would have jumped at the chance.

I would have acquired as much as possible.

As investors and advocates of this technology, we need to maintain that same enthusiasm. If we don’t, we may miss out on the extraordinary returns that could be on the horizon in the next decade.

Chapter 2: The Shift in Market Sentiment

In this video titled "Don't Buy Bitcoin, Buy Ethereum Instead (Sorry)," viewers are presented with arguments for considering Ethereum over Bitcoin. It highlights the current market sentiment and why diversifying into Ethereum might be a wise decision.

The second video, "What to Mine says we are Losing Money !?!? Do I turn off my rigs???" explores the challenges faced by miners in the current economic climate. It raises important questions about profitability and the future of mining.