Bitcoin's Resilience: Why the Crypto Market Isn't Dead Yet

Written on

Chapter 1: The Current State of Bitcoin

A quick search on Google for “Is Bitcoin dead?” yields a staggering 156 million results in less than a second. This indicates a widespread belief that Bitcoin is facing its end.

Last weekend, Bitcoin’s value dropped below $18,000, a significant fall from its peak of over $69,000—amounting to a 74% decrease. While this drop is alarming, it does not equate to the end of Bitcoin. Ethereum and other cryptocurrencies have experienced similar downturns.

I have previously discussed Bitcoin’s puzzling relationship with stock prices and its connection to various altcoins. Although these correlations might seem illogical, they persist. Are stocks dead? Certainly not. Are altcoins finished? Time will tell. This situation reminds me of the dot-com bubble burst, where only the most resilient projects survived, while others faded away. I am confident that Bitcoin will not only survive but will also thrive. Let's explore Bitcoin's history and the reasons for my optimism.

Section 1.1: Historical Volatility of Bitcoin

Bitcoin has faced eight significant corrections, each exceeding 50%. This level of volatility is noteworthy. Many may not realize that stocks also undergo severe corrections; some of the world’s most successful companies have weathered similar storms. For instance, Amazon, one of the leading global companies, has seen its value plunge by over 80% on four separate occasions. Recently, tech giants like Netflix, Nvidia, Meta, and Google have reported declines ranging from 35% to 80%. Yet, none of these companies have been labeled as “dead.”

Subsection 1.1.1: Misconceptions from the Media

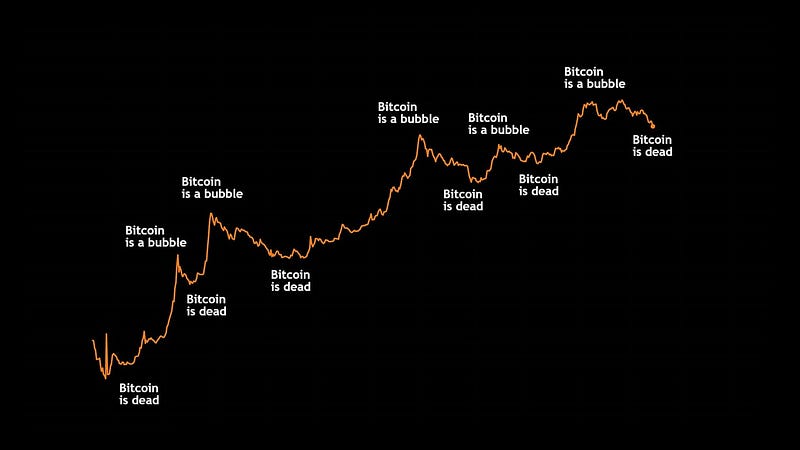

When Bitcoin’s price surges, it’s often dismissed as a “bubble” destined to burst. Conversely, when it crashes, the narrative shifts to “it’s finished.” Perhaps the age-old stock market saying rings true: “The markets climb a wall of worry.”

Journalists have declared Bitcoin dead on numerous occasions throughout its thirteen-year existence, often incorrectly. The Lindy Effect suggests that the longer something survives, the more likely it is to continue. In fact, there have been over 400 instances where media outlets have predicted Bitcoin's downfall. Here are some notable examples of these dire forecasts:

- February 17, 2022: “Bitcoin’s Candle Will Soon Blow Out” - Peter Schiff

- March 8, 2022: “Bitcoin Won’t Be Around A Decade From Now” - Peter Schiff, Economist

- May 18, 2022: “Crypto Is Dead” - Ross Clark, The Spectator

Section 1.2: Future Considerations

Looking ahead, consider the following factors:

- Yearly lows: The lowest points in Bitcoin's price history have been steadily increasing, indicating a trend toward higher lows.

- Stock correlation: As awareness and adoption of Bitcoin grow, its price correlation with stocks should diminish. As I often mention on Twitter, “Bitcoin is widely misunderstood, and we are still in the early stages.”

- Decreasing volatility: As Bitcoin transitions into a more mainstream store of value and speculative trading diminishes, we can expect its volatility to lessen. The presence of leveraged traders, which contributes significantly to this volatility, should also decline.

- A potential “Dot Com” meltdown: Many promising crypto projects have been adversely affected alongside worthless ones. Just as in the dot-com era, the weakest projects will vanish, while the strongest will endure.

The next time you encounter the claim that “Bitcoin is dead,” take a moment to discern whether the writer is discussing Bitcoin specifically or referring to the broader spectrum of crypto, altcoins, stablecoins, or NFTs.

Chapter 2: The Predictions of Detractors

Here's a notable statement from 2018 by economist and Bitcoin critic Nouriel Roubini:

“With BTC down almost 80% from peak (from 20K to ~4K) & all other cryptocurrencies down 80% to 99%, I rest my case that this crypto bubble went bust for good. I feel vindicated. So I will take a break for a few days from this toxic Crypto Twitter. Waste of time to convince zealots.”

The first video titled "Bitcoin, the death of crypto is happening again - this is next" discusses the ongoing narrative surrounding Bitcoin’s viability amidst market fluctuations.

The second video, "Crypto Dead? Not So Fast! Ethereum's Big Boom Ahead!" explores the potential for recovery and growth in the crypto market, particularly focusing on Ethereum's prospects.

Subscribe on Substack — Always Free!

Join Coinmonks Telegram Channel and YouTube Channel to enhance your knowledge of crypto trading and investing. Also, check out our articles on various crypto exchanges and trading strategies.